506 N. Armenia Ave. Tampa FL 33609 | 813-870-3100

Thought for the Day Archive - 2019:

Bankruptcy related insights and information

Thought for the Day Archives: 2005-2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019

12/18/2019

12/17/2019

Student loans typically are not dischargeable in bankruptcy. However, there are exceptions.

12/11/2019

University Of Phoenix Reaches $191 Million Settlement With FTC, Including Debt Relief

12/10/2019

12/6/2019

12/1/2019

11/27/2019

11/26/2019

11/20/2019

11/19/2019

11/18/2019

11/13/2019

11/12/2019

11/10/2019

Thank you to all veterans for their service.

10/29/2019

10/29/2019

10/23/2019

10/21/2019

10/15/2019

10/15/2019

Competent counsel will rely not only on the client's memory for creditors, but will review credit reports and court records to attempt to insure all creditors are timely scheduled on the bankruptcy papers.

10/8/2019

10/4/2019

9/26/2019

How Consumer Remedies Were Gutted By Little- Noticed Tax Code Changes

9/25/2019

9/24/2019

9/23/2019

9/17/2019

9/15/2019

9/12/2019

Secured debts are linked to an asset, like a home or a car. Chapter 7 bankruptcy can discharge most types of unsecured debt. If most of your debt is secured or nondischargeable, Chapter 13 may be a better option. A bankruptcy attorney can help you determine which chapter is right for your situation.

9/9/2019

Filing for bankruptcy may help when you have more debt than you can handle. Chapter 7 wipes out many kinds of debts, while chapter 13 allows you to make lower payments as part of a repayment plan. A bankruptcy attorney can help you determine which option is right for you.

9/3/2019

Judge Jennemann rules in favor of debtor on student loan case, finding that debt to aviation vocational school was not an educational loan subject to §523(a)(8) as it was not made, insured, or guaranteed by the government, and not used for an accredited school. In re Weissmuller, 2019 Bankr. LEXIS 2721, Case #06:08-bk-02958-KSJ; Adv No 6:18-bk-00128-KSJ, Bankr. MD Fla. 27 August 2019)

9/2/2019

Attorney competence is not a given. Too often I meet with clients that have seen other attorneys, and who have given bad advice. Most recently an attorney had told a client to stop paying on all credit cards, but did not tell them to close their bank account at the bank where a credit card was owed, resulting in the bank taking all the money from that account. A very predictable outcome. Counsel are also required to give disclosures within 5 days of the initial meeting. These disclosures are on my website under the selected forms tabs, and I have all clients sign them at the initial meeting. Yet most clients who see me after meeting other counsel have never seen these.

8/30/2019

8/29/2019

Bankruptcy petitions for consumers and businesses are on the rise.

8/27/2019

8/27/2019

8/26/2019

8/23/2019

8/22/2019

8/20/2019

8/16/2019

8/14/2019

8/12/2019

8/8/2019

8/6/2019

8/6/2019

8/5/2019

7/30/2019

7/25/2019

Florida has a generous exemption for homesteads, meaning if you are current on the home, you can almost always keep it in bankruptcy. Even if you are not current, bankruptcy can provide options to still keep it, including catching up the missed payments over as much as 5 years, and possible modification of the mortgage. Less often (though much more often for farmers or fisherman) people filing bankruptcy can rewrite the terms of the mortgage, or even make monthly payments over time then provide for refinancing of the property before a plan is over.

7/24/2019

7/22/2019

Three people explain what led them to file for bankruptcy and how it affected their lives.

7/17/2019

7/16/2019

7/10/2019

7/9/2019

7/8/2019

Detailed analysis of 523(a)(2)(A) and (a)(6) from SDNY District Court.

7/1/2019

6/27/2019

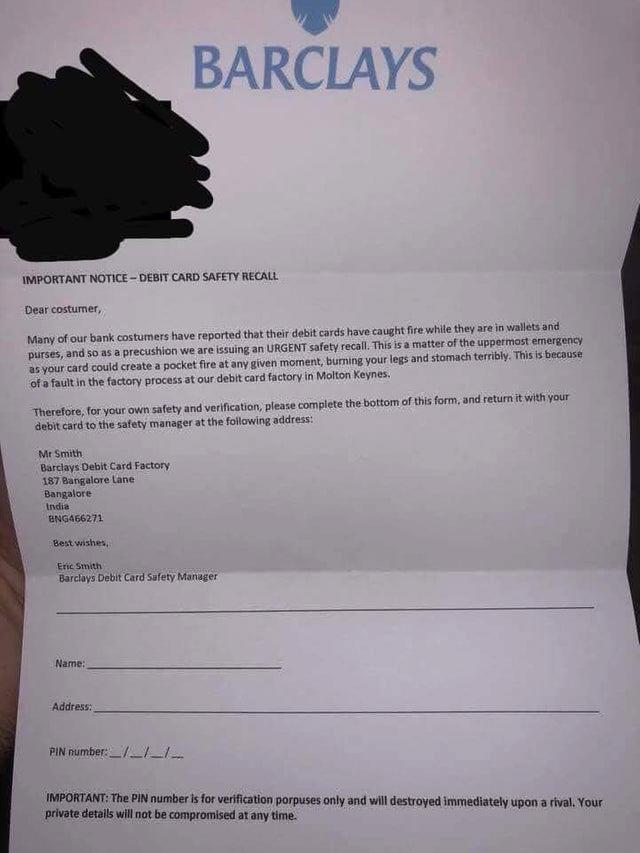

One should always be aware of scams out there, but this one was just too funny to ignore.

6/24/2019

6/19/2019

Bankruptcy will affect your credit for different lengths of time depending on which chapter you file. Chapter 7 bankruptcy, or liquidation bankruptcy, stays on your credit reports for 10 years. Chapter 13 bankruptcy stays on your credit report for seven years. The good news is that credit-scoring models focus more on recent history than years-old credit information.

https://www.nerdwallet.com/blog/credit-cards/credit-report-public-records-hurt-bankruptcy-liens/

6/18/2019

There's a lot of false information surrounding #bankruptcy . Here's what you really need to know about it.

6/7/2019

5/29/2019

5/27/2019

In honor and respect of those that died for our freedom.

5/26/2019

5/13/2019

5/13/2019

5/8/2019

5/5/2019

5/3/2019

4/16/2019

Defalcation in a fiduciary capacity still has a mental intent requirement.

4/15/2019

One of the most important aspects of finding a great attorney is the communication by the attorney with the clients, not just responding to the client but proactively reaching out for issues. This is why I am sending out followup letters to all my pending chapter 13 clients that have not yet sent me their 2018 tax returns reminding them of the need for these returns in bankruptcy, and will be sending another followup in 60 days if I still haven't gotten them. This should avoid requests by the trustee to dismiss the cases.

Communications with clients is one of the subjects that has concerned me for some time, seeing issues both from clients who had other attorneys before me and at the pro bono clinic. This is why I suggest the subject and was a panelist at a local bar seminar on the issue.

4/14/2019

Judge Williamson rules on what happens to insurance check for damages to home in chapter 13. State court counsel suing insurer was unaware of bankruptcy, therefore not employed by the court, and did not get court approval of settlement against insurer. Insurance sent separate checks to counsel for fees and damages, then put a Stop payment put on damages $25,429 check when insurance company realized debtor was in bankruptcy. Unfortunately stop payment was made after attorney sent his trust check to debtor and debtor cashed the check. (Moral: Never issue checks from trust before funds clear!). State court counsel request that the court hold both debtor and debtor's counsel in contempt - debtor for not turning over $20,000 they initially claimed they still held (changing their story later) and mortgage requested that funds be turned over to them.

Court ruled that Debtor had right to use to repair home, but as there was no proof it was used for that purpose, lawyer must deposit replacement check in his trust account and process set up for debtor to show the proceeds were used for required repairs, if not stay lifted for mortgage. State court counsel in suit against insurer never employed by bankruptcy court; no approval of compromise by court.

In re Pereira, 2019 Bankr.LEXIS 1057, 2019 WL 1552555, case #8:14-bk-01703-MGW (Bankr. M.D. Fla. 5 April 2019).

4/14/2019

Judge Jackson in Orlando rules that debtor with 2.95 acre homestead inside city limits must allow sale of property, with proceeds allocated based on percentage of exempt acreage to total acreage. only 0.765 acres above ordinary high water mark including debtor's 10,000 square foot home, and 2.185 acres below ordinary high water mark. City had previously disallowed division of submerged land from deed to home property, and court ruled that the submerged portion could not be legally divided. However debtor created separate parcels just prior to bankruptcy listed separately on schedule A and exempted only homestead land. Court found this attempt to gerrymander exemption was improper, but declined creditors request to disallow exemption on that basis. In re Cole,2019 Bankr.LEXIS 1059, case #6:15-bk-06458-CCJ (Bankr. M.D. Fla. 3 April 2019).

4/4/2019

3/29/2019

Bipartisan bill introduced to help farmers, raising debt limit in chapter 12 to $10 million.

3/26/2019

Judge calls debtor's attorney to testify when debtor's schedules are inaccurate and debtor indicated that she repeatedly gave information to counsel. In re Spearman, 2019 Bankr.LEXIS 901 (Bankr. D.Md. 22 March 2019).

It is critical to hire an attorney who can take the time to review your situation, and timely respond to your issues. High volume bankruptcy mills may have difficulty with this.

3/17/2019

7th Circuit rejects bankruptcy court's broad rulings keeping assets in estate post-confirmation.

3/15/2019

3/12/2019

Avoid problems by hiring board certified counsel. Another case was reported where a debtor nearly had his case dismissed due to a mistake by counsel. In this case, just because his attorney did not file an amendment to disclose a lawsuit settlement as required. This, even though the settlement was disclosed to the chapter 13 trustee and used to complete payments in the plan. In re Maxwell, 2019 Bankr. LEXIS 719 (Bankr. N.D. Ill. March 6 2019).

Hiring experienced board certified counsel can avoid many such pitfalls.

2/25/2019

2/24/2019

2/14/2019

2/5/2019

Clients sometimes get a 1099c form asserting forgiveness of debt income for debts that were discharged in bankruptcy. Use form 982 from the IRS to show that this is not taxable income.

1/19/2019

Many government workers and contractors are being financially stressed by the government shutdown. I am committed to working with anyone having to deal with this problem to insure their ability to obtain relief through the bankruptcy system.

Over 25 Years in Florida

Michael Barnett has provided his services in and around Tampa, Florida covering Hillsborough, Pasco and Polk County for over 20 years.

Board Certified

Mr. Barnett is board certified by the American Board of Certification in consumer bankruptcy law, and has been board certified since January 1993.

BBB Accredited

The BBB has determined that this business meets accreditation standards.